Munsalik – Digitizing Microfinance

A single connection = Access to the financial ecosystem! Simpler, Better, Faster!

What We Do

Munsalik Digital (Private) Limited is a wholly owned, for profit, subsidiary of Pakistan Microfinance Network. MDPL is a technology services company with a vision to be the leading shared services platform that provides end-to-end digital connectivity with the financial ecosystem.

MDPL aims to enable microfinance providers, institutions and banks to digitally manage the loans including the loan disbursements and repayments through a shared digital services platform (“DSP”). DSP will also provide transactional banking functionalities like account opening, servicing loans, processing payments, calculating interest, managing customer accounts, maintaining transaction records and supporting regulatory reporting.

Its core objective is to affect a paradigm shift by moving away from siloed infrastructure resulting in efficiencies and reduced risks, which creates focus on core business for our members. This will be a boutique platform which will encapsulate innovation in the financial ecosystem.

In Pakistan, as highlighted by the National Financial Inclusion Strategy (“NFIS”), the current penetration of microfinance stands at 7.5 million active borrowers which is still low given the 15 million active borrowers target laid out by the NFIS.

After the introduction of MDPL’s shared digital services’ platform, the penetration of micro finance services would accelerate.

What We Do

Core Value

1

Centralized state of the art shared Loan Management Syste(“LMS”) and shared middleware (IRIS) eliminating redundancies in infrastructure investment

2

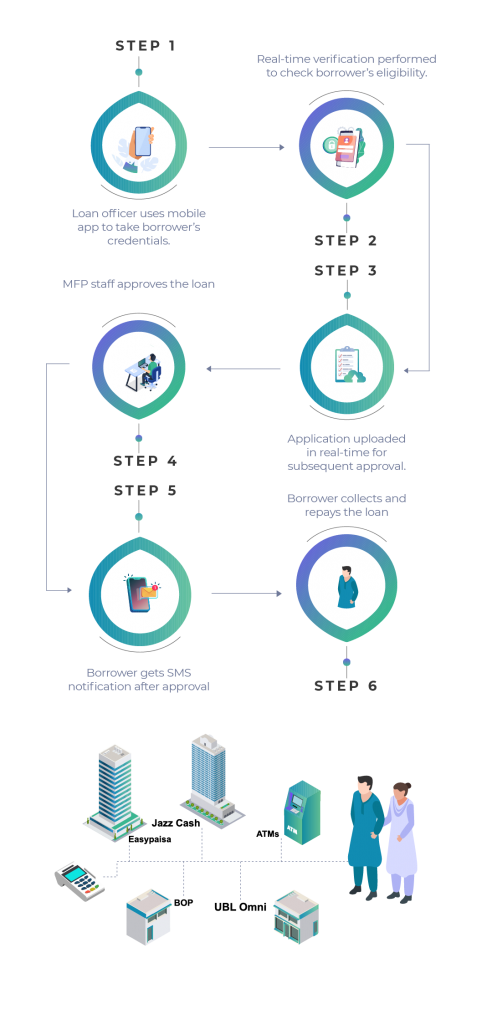

Revolutionizing customer journey through a many-to-many model for real-time loan disbursement & repayment transaction

3

Diverse spectrum of value-added services through integration with NADRA, Credit Bureau, MPG and AM L/CFT etc

4

Connecting Financial Ecosystem with the Microfinance Industry through a single point of contact

5

Equipped with Loan Officers’ Mobile Application for end-to end backoffice Automation.The Benefits of

Munsalik

- Saving on technology costs of setting up your own infrastructure

- No need for individual agreements with DFS players / Banks / Financial Infrastructure providers

- Industry wide negotiated rates

- Frictionless customer experience from account opening to loan disbursement and loan recovery

- Standardization of loan disbursement and recovery processes

- Standard reporting in line regulatory requirements

- Per transaction based billing

- Shorter customer on-boarding time

The Rationale for

Munsalik’s Shared Services Platform

New generation technology infrastructure is still very expensive and out of reach for majority players

One-to-One model limited options for clients for loan cash-out and repayment

Manual Process of client acquisition and loan approval, limits staff productivity

Negotiations in isolation – for pricing and optimum services from DFS players & technology vendors

Absence of synergies – leading to redundancies & limiting network effect

Our Clients

Banking Partners